Mackin teaching with purpose, encouraging self discipline with money

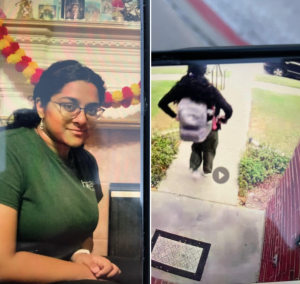

Coppell High School Money Matters teacher Megan Mackin helps sophomore Emma Harper with her budgeting project during sixth period on Thursday. Students in Mackin’s class learn the importance of managing money. Photo by Camila Flores.

October 4, 2019

After spending three years in the corporate world as an information technology consultant, Coppell High School Money Matters and Dollar and Sense teacher Megan Mackin switched careers to fulfill her calling of making an impact on others’ lives. Money Matters and Dollars And Sense focus on consumer practices and responsibility, decision-making skills and preparation for human services careers.

How did you get started in teaching?

I went to Baylor University and there I studied corporate communications, not education. I was an IT consultant at CGI, a company founded in Montreal, Canada and shortly afterwards I started my online teaching course. Baylor taught me a lot about humanitarians, serving and focusing on our community. When I graduated and started working, I didn’t get to use the lessons I learned in Baylor and I felt like I was missing something.

Why did you decide to come to CHS?

I met CHS associate principal Melissa Arnold at a teacher job fair. I came and spoke with her and CHS Principal Laura Springer about the Money Matters teacher’s position. I really loved and aligned with Mrs. Springer and Ms. Arnold’s philosophy about loving kids and teaching them about the real world; for example, teaching them about character. I wanted to follow in their leadership and I was excited to come here.

Why do you like teaching Money Matters and Dollars And Sense?

I love my content. I love it so much because I know what it was like to get out of college and have your first salary and income and think to yourself, “What do I do with this money?” I love building budgets and creating saving plans. I love how you can give people control of their money when a lot of times money feels like something out of their control, but there are tools we can teach to help them find control over that.

What are your goals for this year?

In terms of content, I would like a 90% passing of the Personal Finance Precision Exam. Also, the top goals of my class is if my students can come out of my class and have an emergency savings account with at least $500 in it. If they can get out and really budget and understand what a budget looks like, that would also be one of my top goals. Additionally, in terms of character, my top goal would be encouraging self-discipline which could be achieved by understanding the impact of credit cards, debt, car payments and making these decisions and committing to them when you are only 20 years old. It’s really important to understand the weight of these decisions.

What aspects of your class do you hope your students will carry with them in the future?

The most important thing would definitely be the emergency fund because rainy days do come, and if you don’t have that money to lean on, where are you going to pull that money from? A trait that is important that I hope my students will carry on is self awareness and respect. For example, you have to know your spending habits and when you are in the professional world, you have to respectfully communicate with one another so they can express their different opinions.

Follow Laasya (@LaasyaPA) and @CHSCampusNews on Twitter.