Opinions Editor

Saturday afternoons for Coppell senior Brianna Dyson are not spent with friends at the movies or relaxing at home. Dyson can be found at the Andy Brown West concession stand serving kids and parents during youth sporting events.

Her paycheck is not for movies or clothes or the new iPhone. It is being put aside for her college expenses.

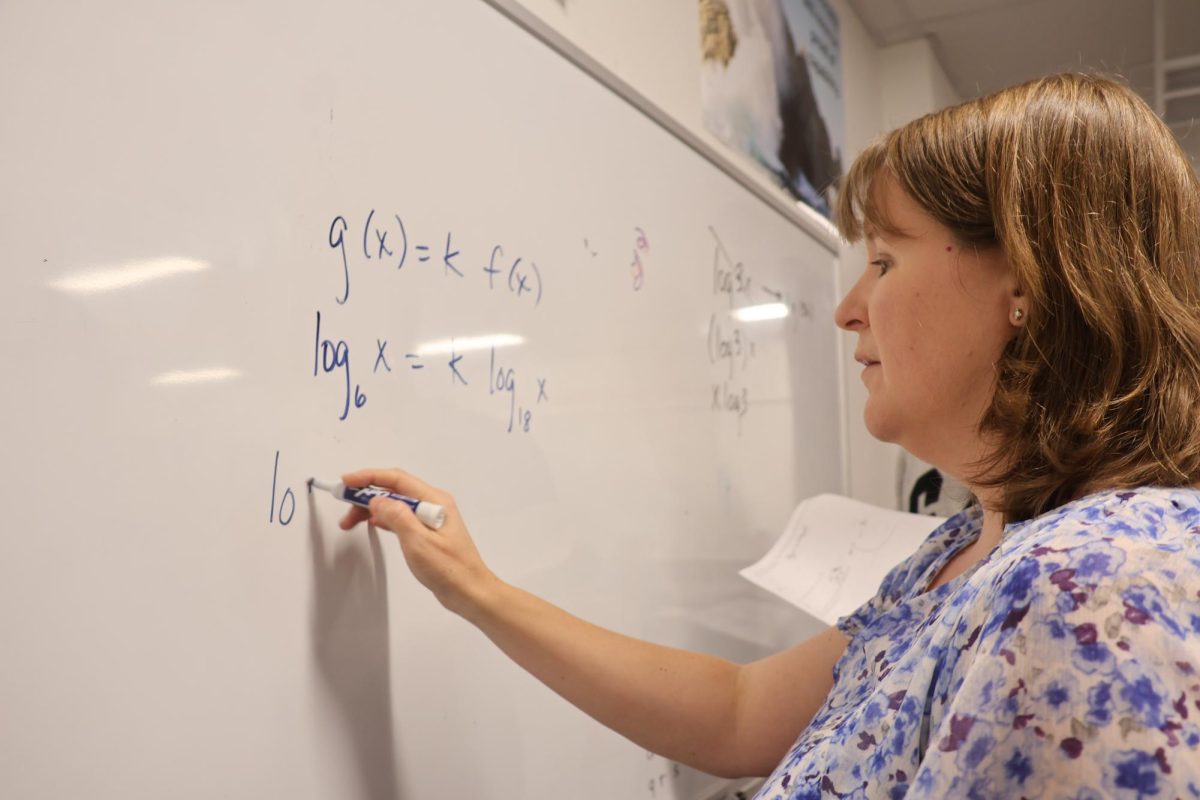

One of the many skills that teenagers must learn before they graduate high school is how to manage their money. This is an invaluable skill that, if not learned properly, can lead to financial problems later in life.

Money management is something that changes with the person managing their money, since the person’s needs change as they grow into new stages of their lives, be it high school, college or beyond. While most high school students do not have investments or taxes that they manage, they do still have money and simple expenses to budget, such as clothes, entertainment and food. Some do not spend as much as others.

“I usually wait until I get a gift card to a store or something,” Dyson said. “Then I go buy something small, like a shirt or something.”

Students at CHS have a variety of methods for managing their money. Some older students have jobs, while some students may have been unable to find a job due to the downturn in the economy.

One especially expensive thing that many students have to buy, regardless of whether or not they have a job, is gas.

“I put all of my money in the bank, except for gas,” Dyson said. “The other day, I spent $60 on gas, and I didn’t even fill my car up all the way. The [gas gauge needle] was only a little past the halfway mark.”

Like most seniors, Dyson has a job. She works at various concession stands throughout Coppell, but mostly the one at Andy Brown West. However, many seniors, as well as most of the population of underclassmen, do not have jobs and have to use whatever money they can get from presents and holidays.

“What I do is I have to make my Christmas money last,” junior Anna Maxfield said. “Since my birthday is really close to Christmas too, I use that and then beg money off of my dad. It kind of works since I only really use my money to buy gifts for my friends’ birthdays and stuff.”

Many seniors plan to save up for college through their jobs. Senior Tatyana Harris is using her part-time job at the Gideon Tutoring Center to save enough spending money to get her through her first year.

“What I do is, because my mom helps me out and so does my dad, I have saved every penny I’ve made at Gideon in a bank account for college,” Harris said. “And the only thing I’ve really used it on was to get my iPhone 4s.”

Once a student leaves high school, the expenses change to include a broader scope of things. Some students have student loans they now owe, and they have textbooks to buy and classes to pay for

“I guess one thing you realize when you get to college is how much everything in your life costs,” 2011 CHS graduate Ashleigh Heaton said. “You don’t really think about that. My parents are paying for my college, I mean my undergraduate college, so that’s good, but I still get the bills and I see how much they’re paying and it always makes me feel kind of bad.”

In many cases, even though students have their parents or scholarships to pay for college, at this stage are also paying for most of their other “smaller” expenses such as food and clothes.

“As long as I don’t go off campus and buy anything, I can just charge it to my college account,” 2011 CHS graduate Dalton Brooks said. “Everything’s pretty much paid for by my parents with my college account. You pretty much have a credit card with the school and you can use it to buy things you need.”

Nevertheless, some students find that college expenses can pile up easily. On average, a student pays $1000 just for textbooks for one semester. The books for a freshman English class alone costs $52 at UT, and that is for the used books.

“I do still have textbooks and stuff to pay for, which can be really expensive,” Heaton said. “Unless you find some of the really good online used textbook sellers, where you can get them for dirt cheap. So that’s helpful. And I live in a suite so I have to replenish dorm cleaning supplies, so like toilet paper and cleaning stuff and all the stuff I have to get to help.”

Many college students, like Heaton, have a budget for each semester they have saved up from jobs they had over the summer, or graduation gifts that they could make stretch.

“I had some money saved up because I wanted to have some spending money when I got to college,” Heaton said. “But I’ve been trying to save it because I don’t spend money generally. So I don’t go out to eat a lot and also I live in the middle of the city so everything is really close. But you really stop spending when you’re in college.”

Heaton also plans to get a summer job to save up money she can use during the school year. There are also several job opportunities that university students can take during the year as well. Many schools offer jobs tutoring underclassmen or giving tours for the school. The students do get paid, although some schools choose to take off of the student’s dorm or tuition costs instead.

“People going to college should definitely apply to be an [resident advisor],” Heaton said. “Because it’s basically, you work, and they pay for your room and board. It’s a really great opportunity.”

Students in college can organize their spending by keeping track of it online.

“I do most of my banking online, so I keep track of it through that. I have about $500 saved up for me,” Heaton said. “I try my best to not spend over $500, that’s the goal. But I track it online, and also when I go home each semester and tally all of my receipts and make sure what’s online on the bank account statements is correct.”